iEdge S-Reit Index Weekly Review 8 Apr 24

Hey all! How have you been? It has been an interesting week for SREITs and I am excited to share about it!

Singapore Real Estate Investment Trust (S-REIT) Sector Developments for the week

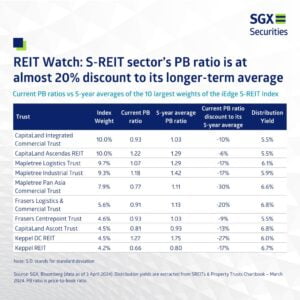

In a latest sharing by SGX Securities, we note that the S-REIT sector’s PB ratio is at almost 20% discount compared to the 5 year average.

While this suggests that you can buy in at an attractive price, in my opinion it is also vital to understand the circumstances which brought the discounts.

For example, while the Mapletree Pan Asia Commercial Trust is at a huge discount of 30%, its interest coverage ratio ICR showed a decline, moving from 4.9x in Q1 FY2022/23 to 3.0x by Q2 FY2023/24.

The interest coverage ratio is a financial metric used to determine how well a trust can pay the interest on its outstanding debt. MAS had previously proposed to require S-REITs to have a minimum ICR of 2.5x in order to enjoy higher gearing limit of 50%.

As mentioned previously, I lean towards SREITs that demonstrate prudent cost measures and active renewal of their portfolios.

US Economic Data

The ISM Manufacturing PMI came in higher than expected at 50.3 instead of 48.5. This was followed by robust employment figures as the Non-Farm Employment Change performed better than expected at 303k instead of 212k, bringing the Unemployment Rate down to 3.8% instead of the expected 3.9%.

We are getting a mixed bag of signals from the US Federal Reserve. The general take seems to still be a total of 3 interest rate cuts for the year. However, investors are likely concerned that the continued resilience of the US economy may add weight to the narrative of higher for longer, resulting in the S&P500 ending the week red.

The chart above shows a break of inverse correlation between the iEdge S-Reit Index (in blue) and the US 10-Year Treasury Bond Yield (in orange). The US 10-Year Treasury Bond Yield had risen for the week but the iEdge S-Reit Index is still holding at the test of a resistance zone.

The yield on the US 10-Year Treasury Bond is now above 4.4%, showcasing the market’s doubt of a loosening of interest rate regime. It is important for us to monitor this crucially as operating costs which includes interest payments have a direct impact on the performance of SREITs. Despite lackluster performance by the SP500 and STI, investors appear to be satisfied for now that the worst have been priced in for SREITs but this presents a risk as sentiments can be fickle.

Generally, I see the market for the SREIT sector now as a hostage to the US Federal Reserve interest rate regime. We will probably see sentiment based shifts in the short term while the differing qualities of the SREITs play out in the medium to long term. You can see evidently that SREITs with a strong focus on cost management and portfolio revival are rewarded by the market with lesser volatility. Mapletree Industrial Trust and Frasers Centrepoint Trust are examples of quality focused trusts.

The week ahead brings us a number of important US economic data releases, which include:

CPI – Consumer Price Index is important because the price of consumer goods is a significant component of inflation. If inflation is high, a central bank may increase interest rate to mitigate the situation. Speculations of a possible interest rate hike may generate demand for the currency.

This release in particular is anticipated by investors as it will show if the strong figure at the start of the year is a seasonal bump or a return to inflation.

FOMC Meeting Minutes – Monetary policy meeting minutes are given much attention by analysts and investors as it has an impact on the economy. The minutes will be analyzed thoroughly for insights on the economic policy ahead. Significant volatility may be generated if there are unexpected revelations.

PPI – Producer Price Index, measures the change over time in the selling prices received by domestic producers for their output. It’s like a gauge for the cost of goods before they reach consumers, indicating whether producers are paying more or less for the materials and services they used to make products. This can affect the prices consumers will eventually pay.

These US economic data and events contribute to the overall picture of the US economy’s health and guides the US Federal Reserve‘s interest rate policy. It is crucial to stay informed about these developments, as the SREITs sector is highly dependent on interest rate trends for cost management, which affects profits and distributions.

I cannot stress enough the importance of being selective with SREITs investments. Look for those demonstrating prudent cost management and active revitalization of their portfolios as key indicators of potential success.

I invest in the CSOP iEdge SREIT ETF on a weekly basis. This approach allows me to maintain exposure and diversification within the SREITs sector, while also averaging down my overall investment cost.

Found this article useful? Share it and let us all have free coffee from dividends!