iEdge S-Reit Index Weekly Review 18 Mar 24

Good day everyone. Time flies right? Hope you are happy and well.

Singapore Real Estate Investment Trust (S-REIT) Sector Developments for the week

The Business Times reported that for the financial period ended Dec 2023, 6 of the 40 S-REITs and property trusts have partly or fully stopped distributions because of deteriorating balance sheets. I mentioned previously that the higher for longer interest rate environment would result in headwinds. SREITs that are stretched in their financials will be affected more. Therefore, we need to be prudent in our selection of SREITs.

Frasers Logistics & Commercial Trust announced the strategic acquisition of an 89.9% interest in a portfolio of four logistics and industrial (L&I) properties in Germany for €129.5 million (approximately S$188.9 million), at a discount to independent valuations. This move, expected to be both Distribution Per Unit (DPU) and Net Asset Value (NAV) accretive, significantly bolsters FLCT’s L&I footprint in a key market, aligning with its investment strategy to enhance its portfolio weightage in the sector. The acquisition features properties with 100% occupancy, a weighted average lease expiry (WALE) of 6.1 years, and is situated in prime logistics hotspots within the densely populated “Blue Banana” region, reflecting a strategic push towards growth in high-demand areas.

The US economic data from last week is kind of a mixed bag.

Firstly, we have both the Consumer Price Index (CPI), which is a way to track how the prices of common goods and services, like groceries and rent, change over time and Producer Price Index (PPI), which measures the change over time in the selling prices received by domestic producers for their output, coming in higher than expected. This suggests that inflation remains sticky and adds to the higher for longer interest rate scenario.

Having said so, Retail Sales, which tracks the total amount of money spent by consumers at stores, online, and through other sales venues on a wide range of products like clothing, electronics, and groceries, came in lesser than expected. This suggests a weaker economic situation for consumers which may become worse as interest rates remain high.

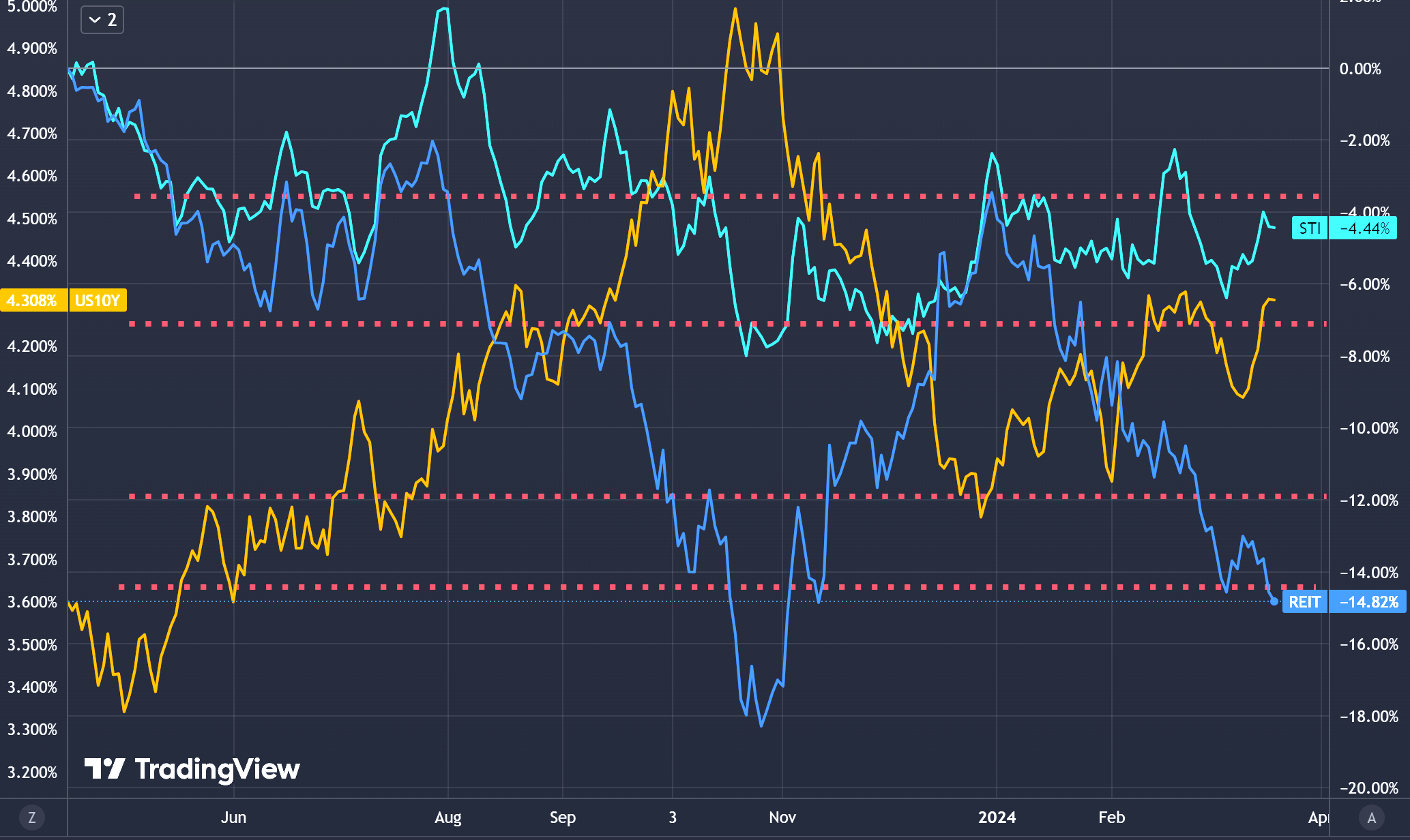

In the chart above, we see that the inverse correlation between the iEdge S-Reit Index (blue) and US 10-Year Treasury Bond Yield (orange) continues.

With the US 10-Year Treasury Bond Yield back above 4.3%, the iEdge S-Reit Index is retesting a crucial support region. If this technical area breaks, we may see the path to the next lower support open, potentially leading to a revisit of previous lows.

In the meanwhile, we see that the STI has diverged from the index, climbing higher for the week.

The week ahead brings us a number of important US economic data which includes:

Federal Funds Rate / FOMC Economic Projections / FOMC Statement / FOMC Press Conference: While it is expected that the interest rate will remain at 5.5%, investors and analysts will be paying attention to the reports and press conference. These are insights to the thought process of the central bank and may reveal clues as to how the current and expected upcoming economic factors can influence policy.

Unemployment Claims, which reports the number of people who have filed for government assistance because they lost their jobs and are looking for new employment. It’s a key indicator of how many people are currently out of work and seeking support, reflecting the health of the job market and the economy.

Flash Manufacturing PMI / Flash Services PMI, which are surveys done with purchasing managers about their opinion on the current business situation.

These data will shape the perception of the US Federal Reserve officials and investors which in turns results in market moves. It is good to be kept informed.

Fed Chair Powell is also scheduled to speak towards the end of the week and may make comments regarding the current inflation / interest rate situation.

As the days unfolds ahead of us, we may continue to face challenging situations for SREITs. This is not likely to go away unless we see a major change in the economic regime such as the cutting of interest rates.

I cannot stress enough the importance of being selective about SREITs. Prudent cost management and active revitalisation of portfolios are good aspects to watch out for.

I continue to invest into CSOP iEdge SREIT ETF weekly to maintain exposure and diversification to the SREITs sector and also to average down my overall cost.

Found this article useful? Share it and let us all have free coffee from dividends!