iEdge S-Reit Index Weekly Review 15 Jan 24

Good day everyone. Hope you had a great weekend. It is time for us to look at what the market is telling us now.

Firstly, let us take a look at the notable recent happenings for SREITs.

Singapore Real Estate Investment Trust (S-REIT) Sector Developments for the week

Daiwa House Logistics Trust acquired a cold storage facility in Vietnam, expected to increase its portfolio valuation and DPU.

OUE Commercial REIT completed a S$22 million asset enhancement at Crowne Plaza Changi Airport, adding new guest rooms and facilities, positioning it well for an increase in tourists and business travelers.

CapitaLand India Trust completed the acquisition of two fully leased industrial facilities, increasing its total completed floor area.

Mapletree Logistics Trust acquired a warehouse in Delhi, India, which is expected to be accretive to its DPU.

Manulife US REIT disclosed a decline in its portfolio valuation by 8% at the end of 2023, and its leverage rose to 58%.

Lippo Malls Indonesia Retail Trust reported an uptick in leverage despite debt reduction.

Keppel DC REIT was the top REIT disposed of by institutional investors in the first trading week, seeing a SGD7.8 million net outflow of institutional funds.

Parkway Life REIT saw a reduction in its stake by Cohen & Steers, a US investment management company.

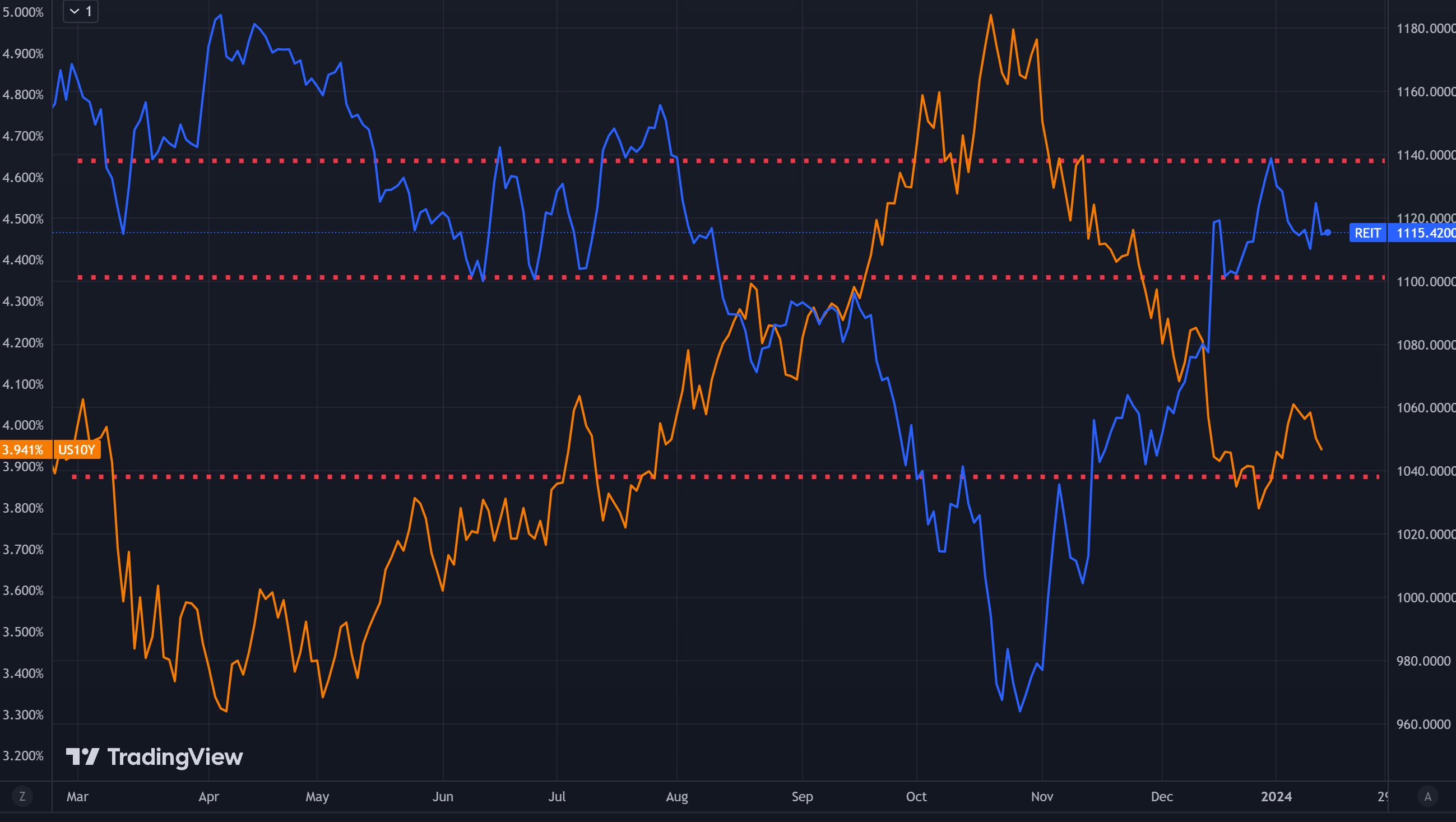

In the chart above, we can see that the inverse correlation between the iEdge S-Reit Index (blue) and US 10-Year Treasury Bond Yield (orange) continues. This means that when the US 10-Year Treasury Bond Yield goes down, iEdge S-Reit Index usually goes up.

Having said so, we see that the iEdge S-Reit Index has weaken recently despite the US 10-Year Treasury Bond Yield easing. This could be traders exiting after the recent run up of S-REITs prices.

The index remains in the zone between the two dotted red lines suggesting continued consolidation. On a side note, the US 10-Year Treasury Bond Yield is now below 4%. If it fails to reclaim that region, we may see further easing.

Considering that S-REITs are sensitive to the US interest rate, it is crucial to be informed of developments in the US.

In December, the headline Consumer Price Index (CPI) in the United States increased at an annual pace of 3.4%, up from 3.1% in the previous month. This rate exceeded the economists’ expectations of about 3.2%. On a month-to-month basis, the index rose 0.3%, compared to 0.1% in November. This uptick in inflation was primarily driven by rising housing costs, which accounted for more than half of the headline increase.

The core CPI, which excludes volatile food and energy prices, showed a slight decrease in its annual rate, moving to 3.9% from 4% the previous month. This indicates some signs of softening inflation.

With such mixed signals, it presents a complex situation for the US Federal Reserve. A reduction of interest rate will probably require significant ease of inflation. This may be the reason why the market is pulling back their expectations of interest rate cuts.

I continue to lean towards prudence and caution.

I prefer S-REITs with lower gearing levels and active debt reduction measures. For example, CapitaLand Ascendas REIT, Mapletree Industrial Trust and Frasers Centrepoint Trust are all below 40%.

While waiting for a pullback, I continue to invest into CSOP iEdge SREIT ETF weekly so as to maintain exposure to the market.