iEdge S-Reit Index Weekly Review 15 Apr 24

Good day all. How are you? Hope all is well.

Singapore Real Estate Investment Trust (S-REIT) Sector Developments for the week

Here are some updates for SREITs

- Mapletree Pan Asia Commercial Trust (MPACT) experienced a significant inflow of institutional funds totaling SGD13.1 million, making it the top Singapore Exchange (SGX)-listed REIT acquired by institutional investors during the week of April 8, 2024.

- ESR-LOGOS REIT divested an Australian asset for AUD65.5 million, which is a 7.4% premium over its valuation, as part of its strategy to focus on core markets.

- Sabana REIT saw an increase in stake by the Switzerland-based Volare Group on April 9, 2024.

US Economic Data

CPI – Consumer Price Index exceeded expectations across all key categories, including Core CPI, month-on-month and year-on-year measures. Investors had previously anticipated that the recent spike in inflation was a seasonal anomaly and expected a return to decreasing rates. However, the persistence of higher inflation figures has led to revised market expectations, anticipating between two interest rate cuts this year to none.

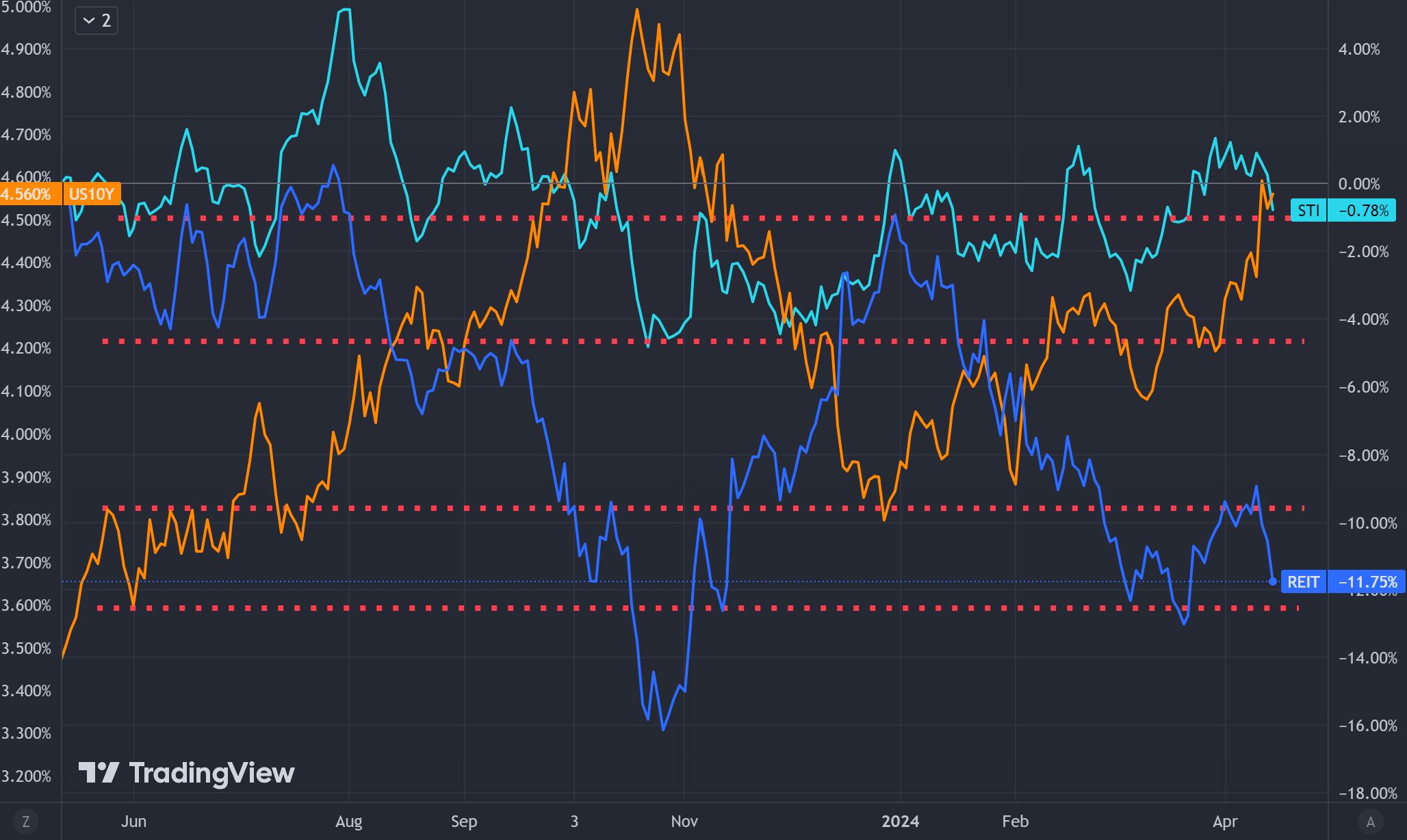

The chart above shows a return of the inverse correlation between the iEdge S-Reit Index (in blue) and the US 10-Year Treasury Bond Yield (in orange). The US 10-Year Treasury Bond Yield had risen for the week and the iEdge S-Reit Index was heading for a retest of a previous support zone.

The yield on the US 10-Year Treasury Bond has risen above 4.5%, signaling growing market concerns about a prolonged period of high interest rates. This is particularly crucial for Singapore Real Estate Investment Trusts (SREITs), as their operating costs, including interest payments, are directly impacted by these rates. Persistent high rates may force trusts to refinance at less favorable terms, potentially increasing costs and squeezing profit margins. SREIT managers might need to explore strategic adjustments, such as securing fixed-rate financing or optimizing asset leverage, to shield earnings and maintain competitive yields.

It’s crucial to recognize that while SREITs may have implemented strategies to minimize the impact of market fluctuations, the short-term outlook for these investments remains influenced by investor sentiment. This sentiment can lead to rapid, sometimes knee-jerk reactions in the market. As investors, it’s important to stay vigilant and consider these reactions as potential risks or opportunities. Understanding the underlying causes of market shifts can help in making informed decisions whether these sudden movements represent a temporary fluctuation or a more significant trend.

The SREIT sector is also experiencing a sharp decline, influenced by heightened risk aversion following recent escalations between Iran and Israel, where hundreds of missiles were fired. This geopolitical tension has raised fears of a broader conflict in the Middle East, prompting investors to seek safety in traditional havens like gold, which has seen a corresponding price increase. The Straits Times Index (STI) has also been impacted, reflecting broader market concerns.

Investors usually shift funds towards assets perceived to offer security in uncertain times, which may have lasting effects on the investment landscape, particularly for sectors like real estate that are sensitive to such geopolitical and economic shifts. It is important that we keep ourselves updated on the developments.

The week ahead brings us a number of important US economic data releases, which include:

Core Retail Sales / Retail Sales – which tracks the total amount of money spent by consumers at stores, online, and through other sales venues on a wide range of products like clothing, electronics, and groceries. It’s a measure of consumer spending, showing how willing or able people are to spend money on goods, which can reflect the overall health of the economy.

Speech by Fed Chair Powell – He may make comments regarding the current inflation / interest rate situation.

Unemployment Claims – which report the number of individuals filing for government assistance because of job loss, seeking new employment. This figure is a critical indicator of the number of people currently unemployed and seeking support, reflecting the job market’s health and, by extension, the overall economy.

These US economic data and events contribute to the overall picture of the US economy’s health and guides the US Federal Reserve‘s interest rate policy. It is crucial to stay informed about these developments, as the SREITs sector is highly dependent on interest rate trends for cost management, which affects profits and distributions.

I cannot stress enough the importance of being selective with SREITs investments. Look for those demonstrating prudent cost management and active revitalization of their portfolios as key indicators of potential success. Such trusts usually suffer less during sell offs.

I invest in the CSOP iEdge SREIT ETF on a weekly basis. This approach allows me to maintain exposure and diversification within the SREITs sector, while also averaging down my overall investment cost.

Found this article useful? Share it and let us all have free coffee from dividends!