iEdge S-Reit Index Weekly Review 12 Feb 24

Good day everyone. Happy Chinese New Year!

It is a day of market closure and things are definitely quiet. I spent sometime reviewing my past actions for the Dividend Portfolio and these are my thoughts.

- The decision to focus on resilient SREITs has paid off. These SREITS generally fall lesser during dips and recovered better during rallies.

- My trades may be too frequent, leading to price concentration. I need to determine a better plan when doing dollar cost averaging.

Singapore Real Estate Investment Trust (S-REIT) Sector Developments for the week

- Keppel DC REIT – In their FY 2023 presentation slides, it was reported that the Guangdong DCs Tenant settled part of sums in-arrears of RMB 0.5m (S$0.1m) End-Dec 2023. Work continues with the tenant on a recovery roadmap. The REIT reserved rights regarding acquisition of Guangdong DC 3.

- CapitaLand Integrated Commercial Trust reported a distribution per unit (DPU) of S$0.0545 for the 2H ended December. This is an increase of 1.7% from S$0.0536 in the previous period.

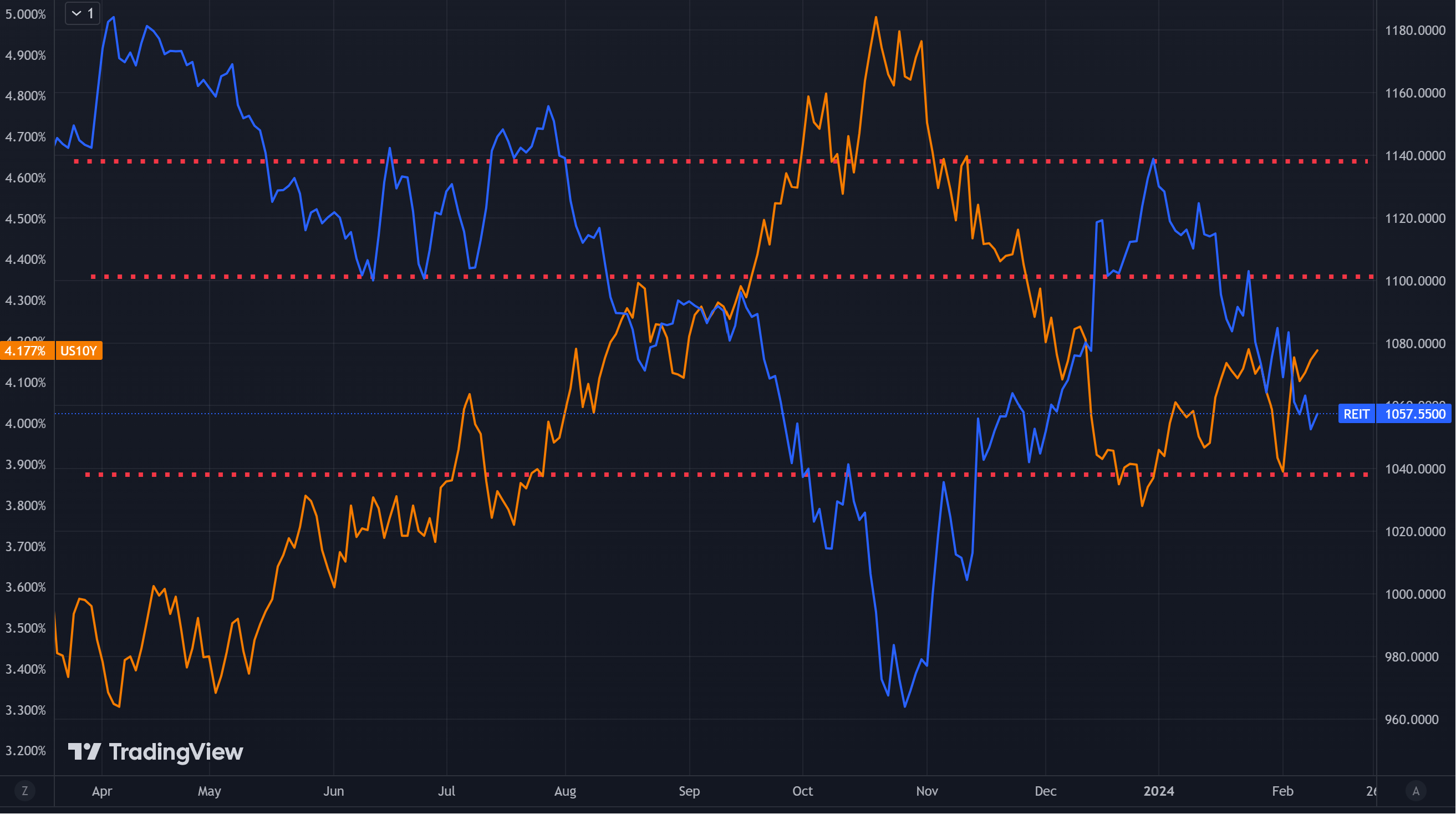

In the chart above, we can see that the inverse correlation between the iEdge S-Reit Index (blue) and US 10-Year Treasury Bond Yield (orange) remains. This means that when the US 10-Year Treasury Bond Yield goes up, iEdge S-Reit Index usually goes down.

The iEdge S-Reit Index has weaken further as the US 10-Year Treasury Bond Yield remains above 4%. The market in general have shifted expectations to fewer rate cuts for 2024. This translates to the anticipation of challenging conditions for the REITs sector and hence prices remain pressured. The index continues towards the next support level.

One of my approach towards selecting SREITs is to see it in action if possible. This is the easiest for retail SREITs.

I have always been impressed with the renewal efforts of CapitaLand Integrated Commercial Trust. Junction 8 is much bigger now and commands a huge crowd. Funan Mall is unique and offers a fresh experience with its steps for chilling out, rock climbing and even a bicycle track passing through it. This REIT is one of the rare gem to have increased their DPU this year.

The same goes for Frasers Centrepoint Trust. Tiong Bahru Plaza had expanded previously and there are always fresh new tenants. Don Don Donki recently opened its doors there. Furthermore, its portfolio of sub-urban malls caters to the needs of the surrounding communities. This translates to a heavy footfall which is good for business. NEX, Waterway Point, etc are always buzzing with activities. Similarly, its price has always been resilient.

As for CapitaLand Ascendas REIT, I have been to a few of the business parks. While I cannot ascertain the performance as easily as the retail REITs, I do see significant activities and footfall. Together with the news reports and presentations, I feel satisfied with the outlook. I recently added to my position. You can see the details in the trading history section.

What do you think of my style? Of course this does not mean I am doing the right way or that it is the best. It is just something that makes me more comfortable with my decisions when coupled with the REITs having good financials such as prudent debt management.

As usual, I continue to invest into CSOP iEdge SREIT ETF weekly so as to maintain exposure to the market. You can also view my latest transactions and portfolio in the links below.

Found this article useful? Share it and let us all have free coffee from dividends!