iEdge S-Reit Index Weekly Review 29 Jan 24

Good day everyone. Hope you had a great weekend.

Today is a sea of red. I reckon most of us would feel uncomfortable seeing it but alas it is but the nature of investing. The market never goes in a straight line. I did an update on my recent acquisitions earlier and allow me to summarize here too.

- Keppel DC Reit is a significant player in the data center sector, which forms an essential component of today’s technology infrastructure. I anticipate continued tailwinds for this sector as the consumption and proliferation of technology persist. Although there are ongoing issues with a China-based tenant, it’s worth noting that this tenant represents less than 10% of Keppel DC REIT’s portfolio, mitigating potential risks.

- Frasers L&C Trust exhibits a strong global presence, being diversified across five major developed countries – Australia, Germany, Singapore, the United Kingdom, and the Netherlands. This diversification marks my initial exposure to the logistics industry within the portfolio. Notably, the Trust boasts one of the lowest gearing ratios among S-REITs, affording it significant room for growth and investment opportunities.

- Mapletree Logistics Trust focuses on a diversified portfolio comprising quality, well-located, income-producing logistics real estate. Its investments span across several key markets, including Singapore, Australia, China, Hong Kong SAR, India, Japan, Malaysia, South Korea, and Vietnam. This broad diversification signifies my portfolio’s initial foray into the logistics industry. Despite some exposure to China and Hong Kong, which may currently face headwinds due to market sentiment, these regions continue to play a significant role in global trade. This ongoing relevance underpins sustained demand in the logistics sector.

Let us take a look at some recent developments for SREITs.

Singapore Real Estate Investment Trust (S-REIT) Sector Developments for the week

- CapitaLand Ascott Trust has posted a 14.1% rise in H2 Distribution Per Share to S$0.038.

- Keppel DC Reit’s distribution per unit for the half year ended Dec 31, 2023, dropped 16.1% to S$0.04332 after its H2 distributable income fell 18.5% to $76.4 million on higher finance costs and a loss allowance allocated for the uncollected rental income from its three Guangdong data centres.

- Frasers Centrepoint Trust is acquiring an additional 24.5% effective interest in the retail mall NEX. The estimated total acquisition cost of SGD523.1 million will be partially financed by raising fresh funds. It has successfully completed a private placement to raise approximately S$200.0 million in gross proceeds at a price of S$2.18 per unit.

- Mapletree Industrial Trust announced that for 3QFY23/24, covering the period from October 1, 2023, to December 31, 2023, distribution to unitholders increased by 3.1% year-on-year to S$95.2 million. However, despite this increase in total distribution, the Distribution per Unit for the same period saw a slight decrease of 0.9% year-on-year, amounting to S$0.0336.

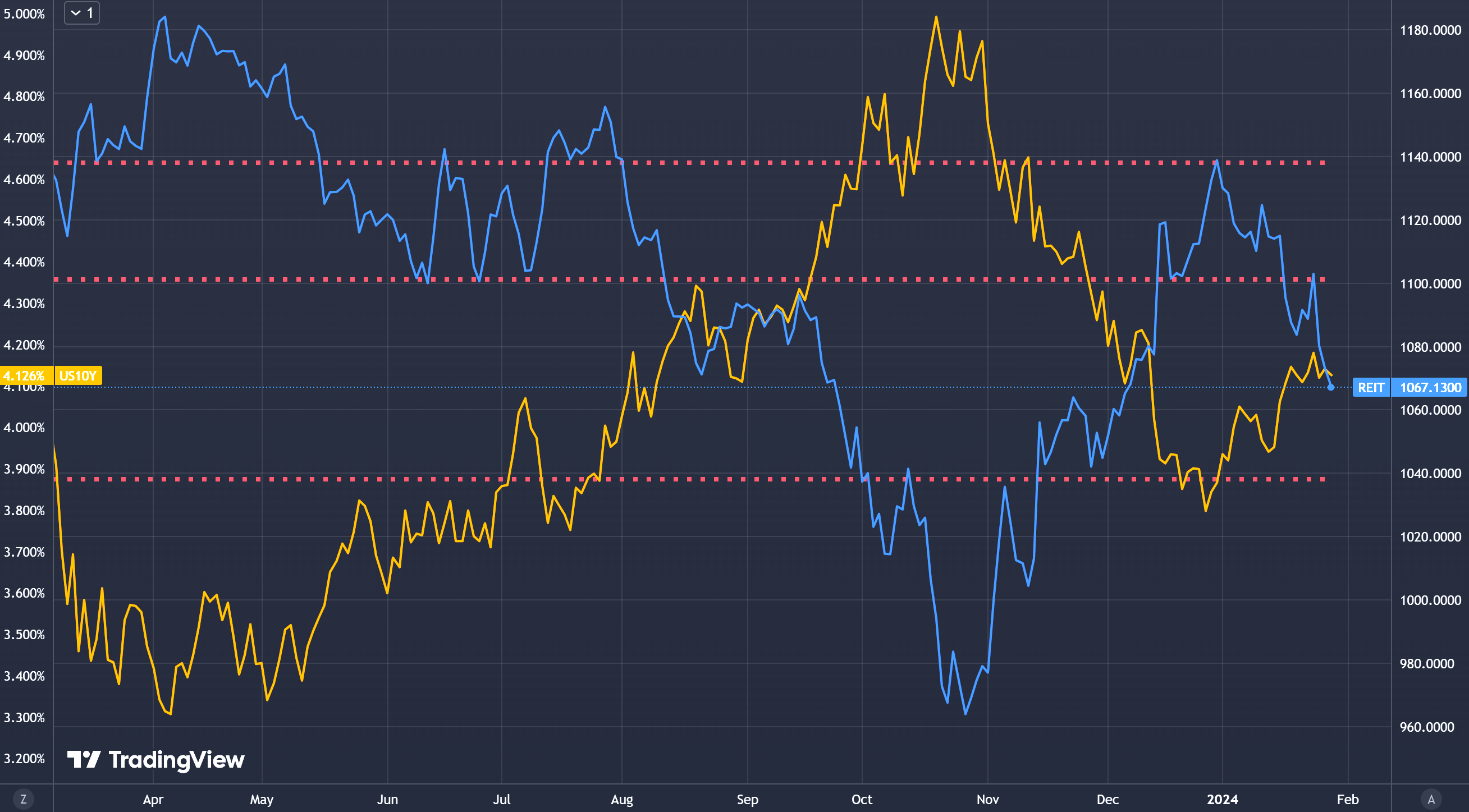

In the chart above, we can see that the inverse correlation between the iEdge S-Reit Index (blue) and US 10-Year Treasury Bond Yield (orange) remains. This means that when the US 10-Year Treasury Bond Yield goes down, iEdge S-Reit Index usually goes up.

The iEdge S-Reit Index has weaken further as the US 10-Year Treasury Bond Yield remains above 4%. This is likely due to the expectation of headwinds caused by a higher for longer interest rate situation.

The index is now below the previous support region and is now mid-way towards the next support level. Based on the historical chart, a test of the next support level may be a possibility especially if the US 10-Year Treasury Bond Yield moves up towards the 4.6% region.

Considering that S-REITs are stocks traded on the SGX, we have to be mindful of the sentimental impact on the prices. Most SREITs are reporting lower Distribution Per Unit and climbing expense for their portfolios. Hence despite not reaching the previous higher levels of the US 10-Year Treasury Bond Yield, many SREITs are facing selling pressure. If you have been following the blog, this will not come unexpected as I have cautioned always that no actual interest rate has been cut yet. A challenging economic environment still persist and as loans are due to be renewed, the higher interest rate will affect the performance of the S-REITs.

With the above in mind, I continue to favor SREITS such as CapitaLand Ascendas REIT, Mapletree Industrial Trust and Frasers Centrepoint Trust that are actively managing their gearing / debt levels and seeking positive renewal to their portfolio. While Keppel DC Reit is facing a sharp bearish pressure, I consider the rental issue to be extra-ordinary and believe that the essential nature of data centres for technology will mitigate the situation in the medium to long term.

I would like to caution again dear readers to not be hyper focused on dividend yields. A higher than normal dividend yield may be because of the depression of stock price or reflection of a higher risk.

Meanwhile, I continue to invest into CSOP iEdge SREIT ETF weekly so as to maintain exposure to the market. You can also view my latest transactions and portfolio in the links below.